BST SẢN PHẨM MỚI

![]()

3.326.000 đ – 3.605.000 đ

Topper

270.000 đ – 285.000 đ

3.375.000 đ

3.625.000 đ

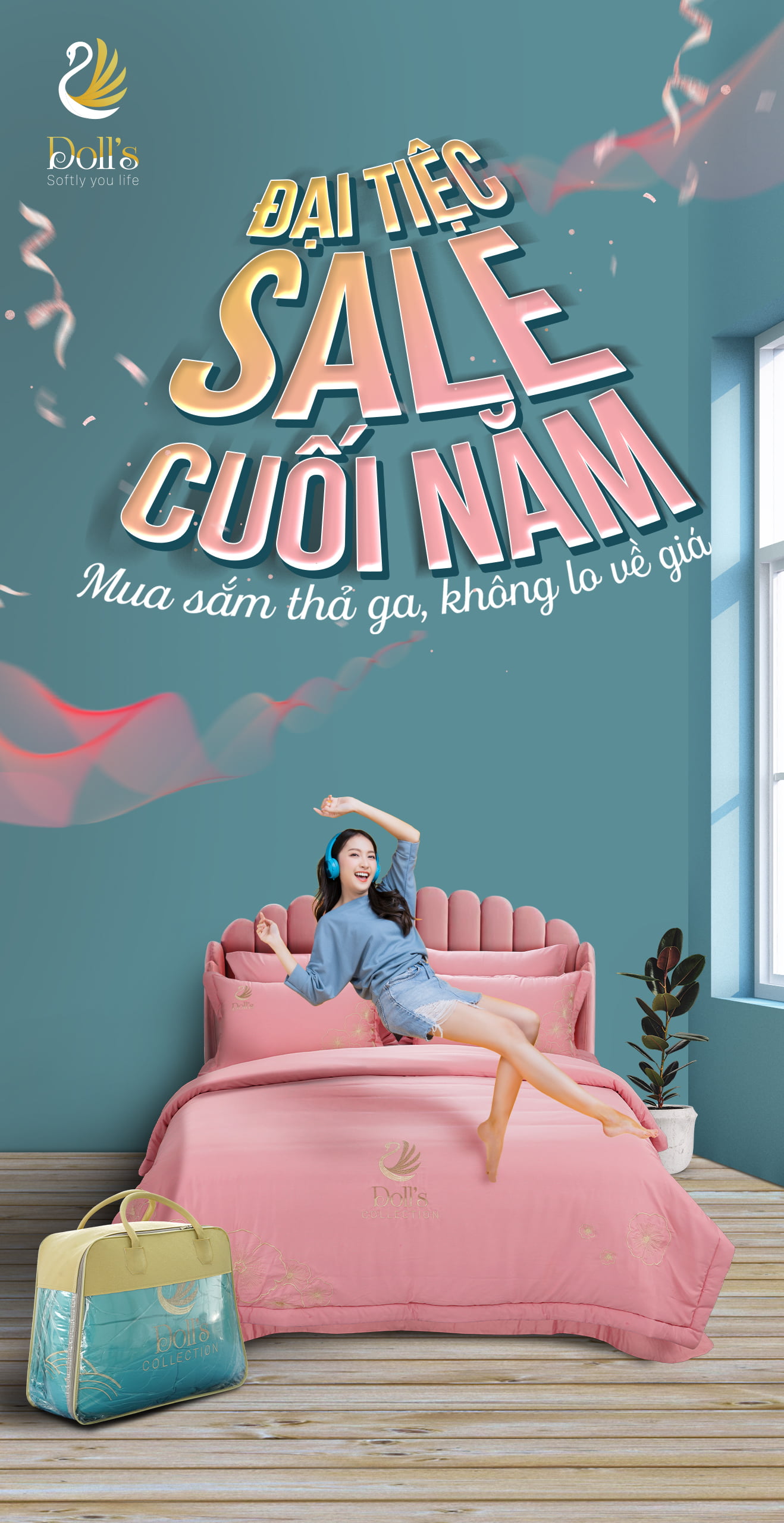

BST DOLL’S BEDDING

![]()

- CHĂN GA

- NỆM

- PHỤ KIỆN CHĂM SÓC GIẤC NGỦ

BST NỆM CAO CẤP

![]()

- NỆM FOAM

- NỆM BÔNG ÉP

- NỆM LÒ XO

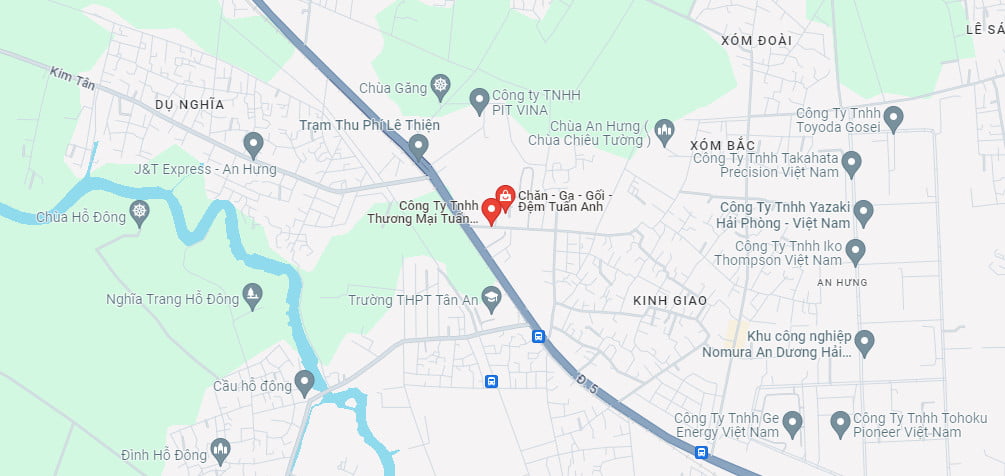

BST CHĂN GA CAO CẤP

![]()

EGYP | TENCEL | COTTON

Upload Image...

Upload Image...

Upload Image...

Upload Image...

KHÁCH HÀNG NÓI GÌ VỀ DOLL’S BEDDING

%3431739071408481%